Bookkeeping can be time-intensive.

Let us take care of it.

Consider us all Virgos. A bunch of perfectionists, we are.

My assistant organizes her clothes by color and sleeve length—so, we deal in details.

We offer timely, efficient bookkeeping services for businesses large and small.

Accounts are presented via Quickbooks for client review on a quarterly, monthly, or annual basis.

Reports can be tailored to your needs and what you need to see,

when you need to see it. Budgeting and forecasting support are also available.

We offer total payroll services for small business clients. This frees up your hands to be doing what's most important.

Friends, family, and of course, celebrating your business success. *cheers*

Services include:

Set up and maintenance of all records

Time card tabulations

Withholdings of tax and benefit contributions

Federal and State tax filings

Issuance of checks

Preparation of W-2's and1099 forms

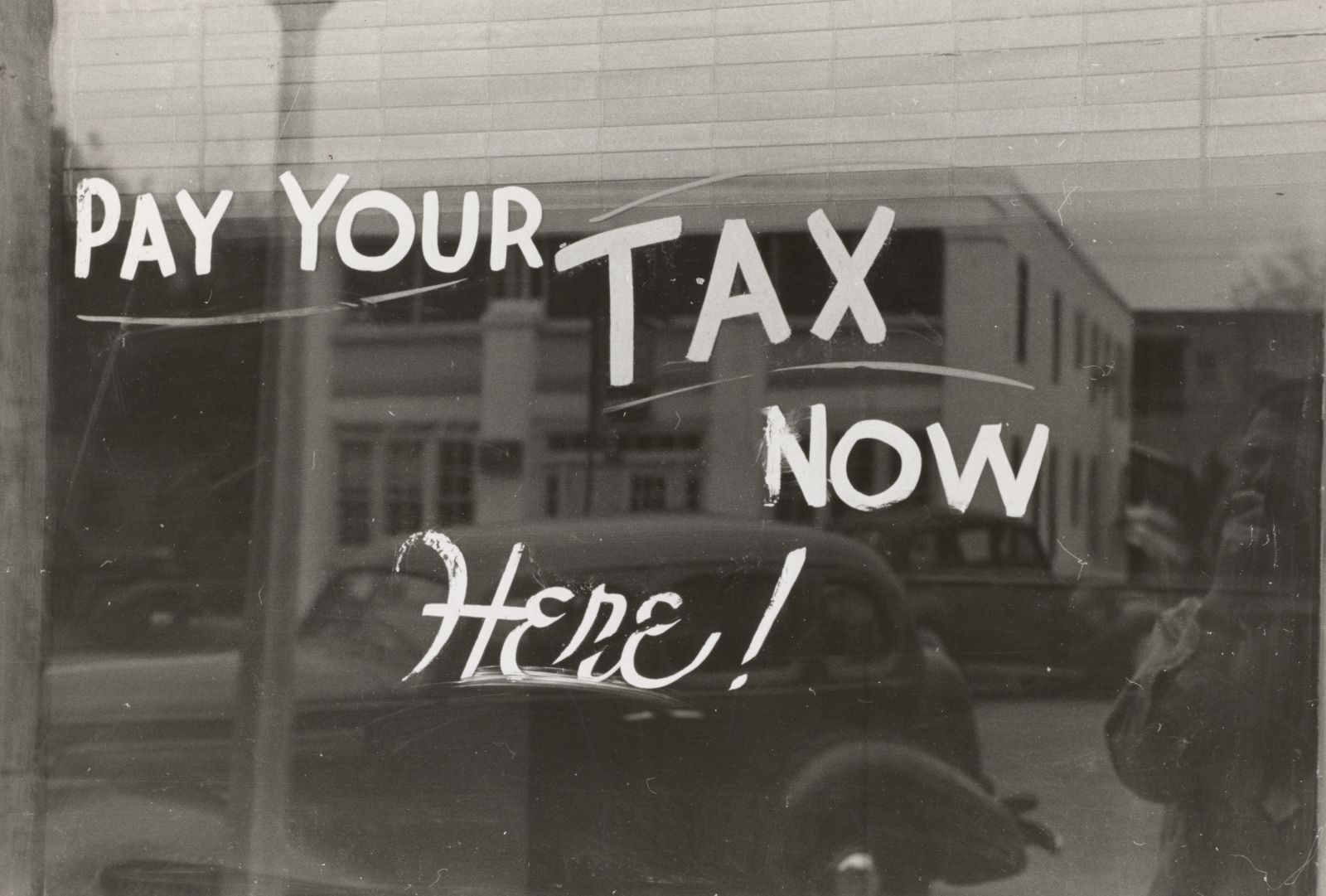

You know how important money and time are. Let us give you a little bit of both.

No more doubting if your return is correct

No more wondering if you’re missing any deductions

No more hours reading up on IRS laws

As the trusted Mr. Ice once said, "If you have a problem, yo we'll solve it..."

But really, take your concerns and amendments to us—that's what we're here for.

You have a million things on your mind, and taxes should not be one of them.

After all, do you want to focus on compliance or helping your business grow?

That's why Small business tax return preparation and filing is a core service offered to our clients.

Whether your company is a C corporation, S Corp, Limited Liability Company, Partnership,

or Sole Proprietor, we'll prepare your tax return and minimize the tax owed.

Over the years, we've helped 100's of small businesses stay compliant and reduce their tax expense.

We'd love to do that for you!

As a CPA, I have the knowledge and expertise to help you with deadlines and deductions,

even in complex situations. Can you do your own tax return? Of course, you can!

And we know you're smart enough to do it. But stop and think for a moment?

Assuming you've done your research and you know how to file your taxes.

Wouldn't it be better if you would have spent that time getting new customers,

training your staff, or improving your operations?

As a business owner myself, I know how you feel. You can, and want to do it yourself.

But just because you can doesn't mean you should. That's also the reason

I wouldn't change my own brakes. Somethings are just better left to the professional.

Contact us now and get back to working ON your business. Not IN it.

Tax Planning:

Let us help you get ahead by planning ahead.

You want to pay less tax (I mean who doesn’t?) but you’re not sure how. That’s where we come in.

Our tax planning service is essential in effectively and legally reducing your tax liability.

We do more than just prepare your tax returns—we proactively recommend tax saving strategies

to keep more money in your pocket.

**Privacy Policy**

This Privacy Policy informs you of our policies regarding the collection, use, and disclosure of personal data when you use our Service and the choices you have associated with that data.

We use your data to provide and improve the Service. By using the Service, you agree to the collection and use of information in accordance with this policy.

**Information Collection and Use**

We collect several different types of information for various purposes to provide and improve our Service to you.

**Types of Data Collected:**

- Personal Data: While using our Service, we may ask you to provide us with certain personally identifiable information that can be used to contact or identify you ("Personal Data").

- Usage Data: We may also collect information on how the Service is accessed and used ("Usage Data").

**Use of Data**

JBA Tax and Accounting uses the collected data for various purposes:

- To provide and maintain our Service

- To notify you about changes to our Service

- To allow you to participate in interactive features of our Service when you choose to do so

- To provide customer support

- To monitor the usage of our Service

**Transfer of Data**

Your information, including Personal Data, may be transferred to — and maintained on — computers located outside of your state, province, or other governmental jurisdiction where the data protection laws may differ than those from the United States.

**Disclosure of Data**

We may disclose your Personal Data in the good faith belief that such action is necessary to:

- To comply with a legal obligation

- To protect and defend the rights or property of JBA Tax and Accounting

- To prevent or investigate possible wrongdoing in connection with the Service

**Security of Data**

The security of your data is important to us but remember that no method of transmission over the Internet or method of electronic storage is 100% secure.

**Service Providers**

We may employ third-party companies and individuals to facilitate our Service ("Service Providers"), to provide the Service on our behalf, to perform Service-related services, or to assist us in analyzing how our Service is used.

**Links to Other Sites**

Our Service may contain links to other sites that are not operated by us. If you click on a third-party link, you will be directed to that third party's site.

**Changes to This Privacy Policy**

We may update our Privacy Policy from time to time. We will notify you of any changes by posting the new Privacy Policy on this page.

**Contact Us**

If you have any questions about this Privacy Policy, please contact us at JBA Tax and Accounting.

**Terms of Service**

By accessing or using the Service you agree to be bound by these Terms. If you disagree with any part of the terms, then you may not access the Service.

**Accounts**

When you create an account with us, you must provide information that is accurate, complete, and current at all times.

**Intellectual Property**

The Service and its original content, features, and functionality are and will remain the exclusive property of JBA Tax and Accounting and its licensors.

**Links to Other Web Sites**

Our Service may contain links to third-party web sites or services that are not owned or controlled by JBA Tax and Accounting.

**Termination**

We may terminate or suspend access to our Service immediately, without prior notice or liability, for any reason whatsoever.

**Governing Law**

These Terms shall be governed by the laws of the United States without regard to its conflict of law provisions.

**Changes**

We reserve the right, at our sole discretion, to modify or replace these Terms at any time.

**Contact Us**

If you have any questions about these Terms, please contact us at JBA Tax and Accounting.

This Web site is made available as a service to our clients and others for informational purposes only. These materials and information should not be considered as, or a substitute for, accounting, tax or financial advice. While it is hoped the materials provided here are helpful as background material, it is not warranted either expressly or implied as accurate or complete. You should refrain in taking any action based upon the information provided here until you have received proper counsel.

In addition, you understand that any links to any other web site or services does not constitute endorsement of or warranty of any service, product or information provided on their site(s). These links are provided for convenience only.

While our intent is to make transmissions to and from this web site secure, it is understood that no warranty of security can be made and that unforeseen security breaches by "hackers" is a possibility, however slight.

Reproduction of part or all of the contents on this site in any form is prohibited other than for individual use only and it may not be shared with any third party. All content on this site is copyright protected and/or trademarked as appropriate and may not be copied, duplicated or altered in any way...

© . All Rights Reserved.